Japanese B2B Buyer Behavior: Unlocking Success in Japan with Data-Backed Insights on Key Differences for Foreign Companies

Are you an overseas company considering entering the Japanese B2B market?

Or perhaps you're already here but not seeing the results you'd hoped for?

Strategies that have brought success in global markets often fall flat in Japan. The behavior of Japanese B2B buyers is deeply rooted in unique cultural and business practices. This article, based on the latest survey data conducted by ITmedia, will explain the key differences in Japanese B2B buyer behavior and provide effective marketing strategies to address them.

Introduction: Why is Japan Different?

The Japanese B2B market is an attractive target for many overseas companies due to its size and maturity. However, to maximize its potential, it's crucial to understand not just the superficial differences, but also the deeply ingrained behavioral characteristics of Japanese buyers. Simply presenting your product or service as you would elsewhere won't capture the hearts of Japanese buyers. Data collected by ITmedia provides concrete guidance on what Japanese B2B buyers prioritize and what leaves a negative impression.

Note on the Surveys: This article draws insights from two surveys conducted by ITmedia: |

Key Differences in Japanese B2B Buyer Behavior: What the Data Reveals

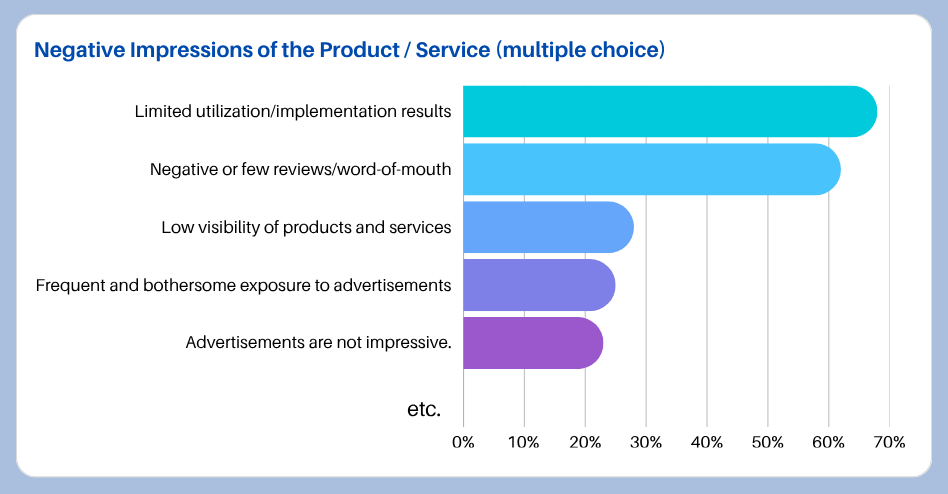

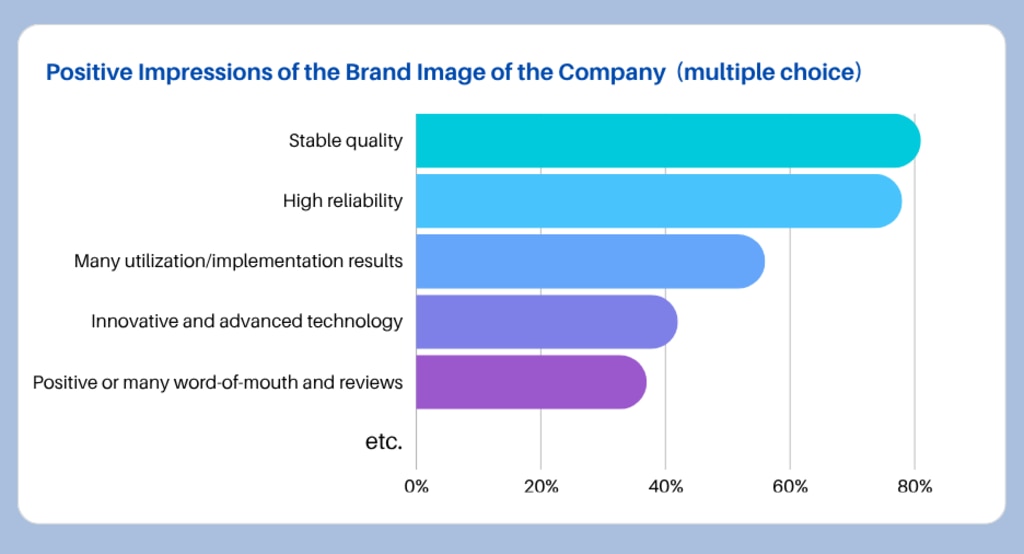

1. Emphasis on Trust and Proven Track Record

In Japanese business culture, building long-term relationships and trust is paramount. This holds true for B2B transactions as well; once a relationship of trust is established, stable, long-term business can be expected.

- Data on Negative Impressions: The most frequently cited factor for a negative impression of a product or service was "limited utilization/implementation results" (68%). Similarly, "negative or few reviews/word-of-mouth" (62%) also created a strong negative impression, indicating that a proven track record and third-party evaluations are highly valued.

- Data on Positive Impressions: Conversely, "stable quality" (81%) and "high reliability" (78%) were the top two factors contributing to a positive brand image for a providing company. Having "many implementation/usage results" also left a good impression on 56% of respondents.

2. Thorough Information Gathering and Content Preferences

Japanese B2B buyers conduct extensive and detailed information gathering when considering product adoption.

- Importance of Information Sources: When collecting information for product introduction, "product provider's website" (75%) and "industry information sites (media, industry magazine websites, etc.)" (55%) were highly emphasized online sources.

- Effective Content Formats: For understanding a product, "product introduction pages on websites" (81%) , "white papers/e-books (2+ pages)" (50%) , "webinars" (47%) , and "videos" (35%) were highly valued content formats, indicating a demand for diverse and detailed content.

- Decisive Information for Candidate Selection: When narrowing down product candidates, "product materials (including product introduction pages on websites)" (76%) , "price lists/quotes" (66%) , and "comparison tables with other companies' products" (62%) were crucial. "Case study materials" were also highly valued at 57%.

- Acceptance of Personal Information Registration: For obtaining content, "know-how materials on interesting themes" (50%) , "product materials" (43%) , "case study materials" (34%) , and "webinars (lectures and discussions)" (34%) were considered acceptable in exchange for personal information, suggesting that practical information is readily exchanged for personal details.

- Utilization of Videos and Webinars: A significant 85% of respondents stated they "frequently watch, actively seek out, or try to watch if available" when it comes to videos or webinars related to product introduction, indicating active engagement with visual content.

3. Communication Sensitivity: Avoiding Negative Impressions

The impression of the sales representative directly impacts the perception of the company and its products/services. Japanese buyers particularly value politeness and consideration.

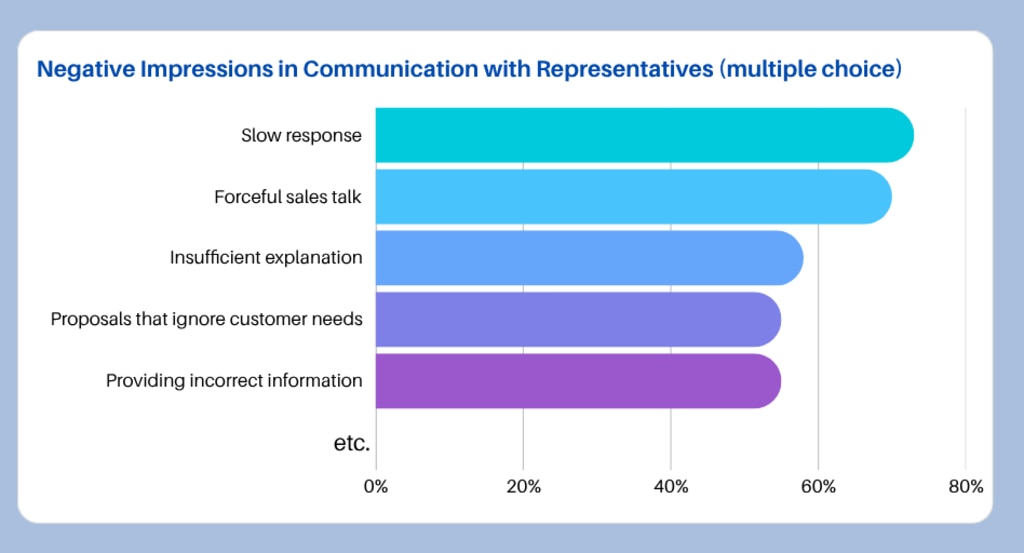

- Negative Impressions in Communication with Representatives: The most frequently cited factor for a negative impression in communication with a representative was "slow response" (73%). "Forceful sales talk" (70%) was also high, indicating that respect for the customer's pace and prompt, polite responses are crucial. Other factors like "insufficient explanation" (58%) , "proposals that ignore customer needs" (55%) , and "providing incorrect information" (55%) also left negative impressions.

4.After-Sales Service and Cost Transparency

Whether a product can be used with peace of mind after implementation and if costs are clear are crucial criteria for buyers.

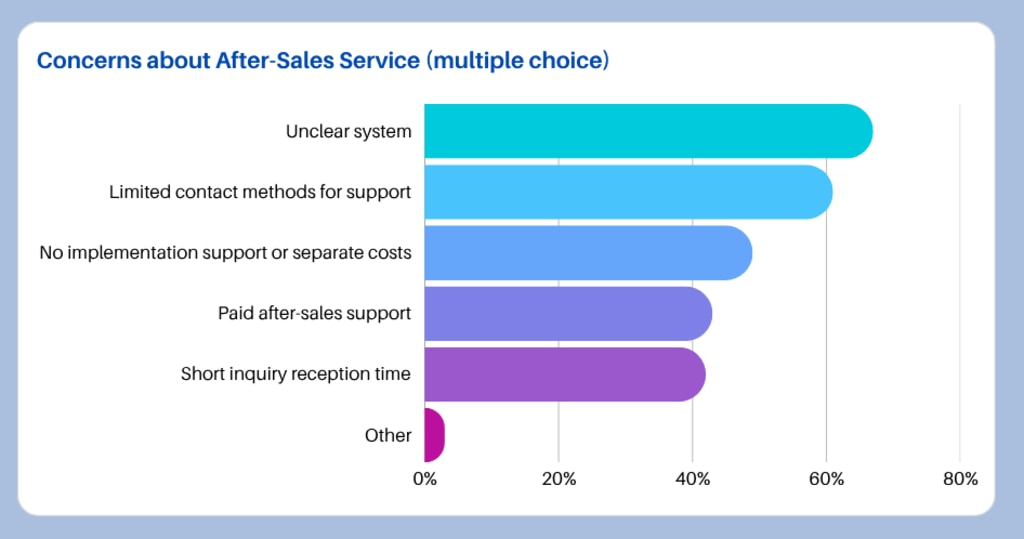

- Concerns about After-Sales Service: Regarding concerns about after-sales service and customer support, "unclear system" (67%) was the most common, followed by "limited contact methods for support" (61%).

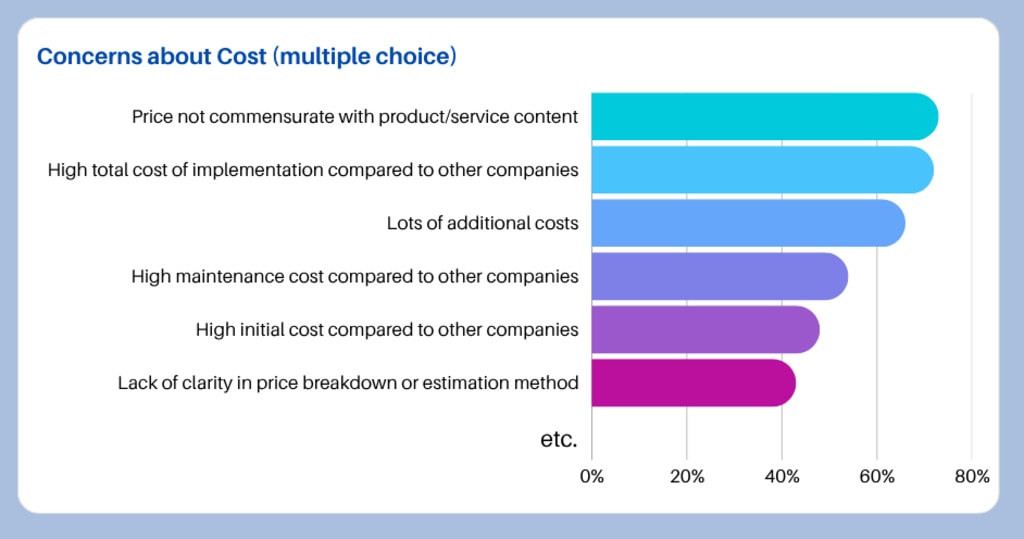

- Concerns about Cost: Cost-related concerns included "price not commensurate with product/service content" (73%) and "high total cost of implementation compared to other companies" (72%). "Lack of clarity in price breakdown or estimation method" was also a significant concern at 43%.

Adaptation Strategies for Overseas Companies: Achieving Success in Japan

Based on the data above, here are concrete strategies for overseas companies to succeed in the Japanese B2B market:

- Focus on Visualizing Achievements and Reliability:

- For Japanese customers, compile detailed materials such as success stories, implementation cases, and specific usage scenarios (e.g., white papers, case study articles).

- Actively collect customer reviews and testimonials, and publish them on your website and in marketing materials to enhance credibility.

- Consistently emphasize the quality, stability, and reliability of your products and services.

- Provide Diverse and High-Quality Information Thoroughly:

- Since Japanese B2B buyers heavily rely on online information gathering, ensure your company website has comprehensive product introduction pages and offers detailed product materials for download.

- Prepare various content formats such as white papers, e-books, web seminars, and videos to help buyers deepen their understanding of your products.

- Present clear pricing tables and comparisons with competitors to ensure transparent information provision.

- Leverage specialized media like ITmedia, which offers services such as lead generation, advertorials, and webinars, to increase the dissemination of third-party information, thereby enhancing recognition as a highly trusted information source.

- Maintain Polite and Prompt Communication:

- Prompt responses to inquiries are essential. Time-sensitive information delivery is crucial, and avoid keeping buyers waiting.

- Avoid forceful sales talk. Instead, deeply understand customer needs and propose solutions tailored to them.

- As some buyers are hesitant to provide phone numbers, prepare multiple valuable content offerings that justify the provision of personal information.

- Ensure Transparency in After-Sales Service and Cost:

- Clearly define your post-implementation support system, including contact methods, operating hours, and the scope of paid vs. free services.

- Transparently explain your product/service pricing and its breakdown, as well as your estimation methods, to alleviate cost concerns.

- Clearly articulate the cost-effectiveness and benefits of your implementation to demonstrate that the price aligns with the value provided.

Conclusion: Success in the Japanese Market Comes from Understanding and Adaptation

Japanese B2B buyer behavior has unique characteristics that differ from those overseas. However, by leveraging data-backed insights like those provided by ITmedia, understanding these differences deeply, and adapting your strategies accordingly, success in the Japanese market is entirely achievable.

Building trust, providing high-quality information, communicating courteously, and maintaining transparent after-sales service and cost structures are key to establishing a competitive advantage in the Japanese B2B market. With patience and continuous effort, you can build strong relationships with Japanese buyers and achieve long-term business growth.